Accident Yr Vs Calendar Yr

By admin / May 26, 2024 / No Comments / 2025

accident 12 months vs calendar 12 months

Associated Articles: accident 12 months vs calendar 12 months

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to accident 12 months vs calendar 12 months. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

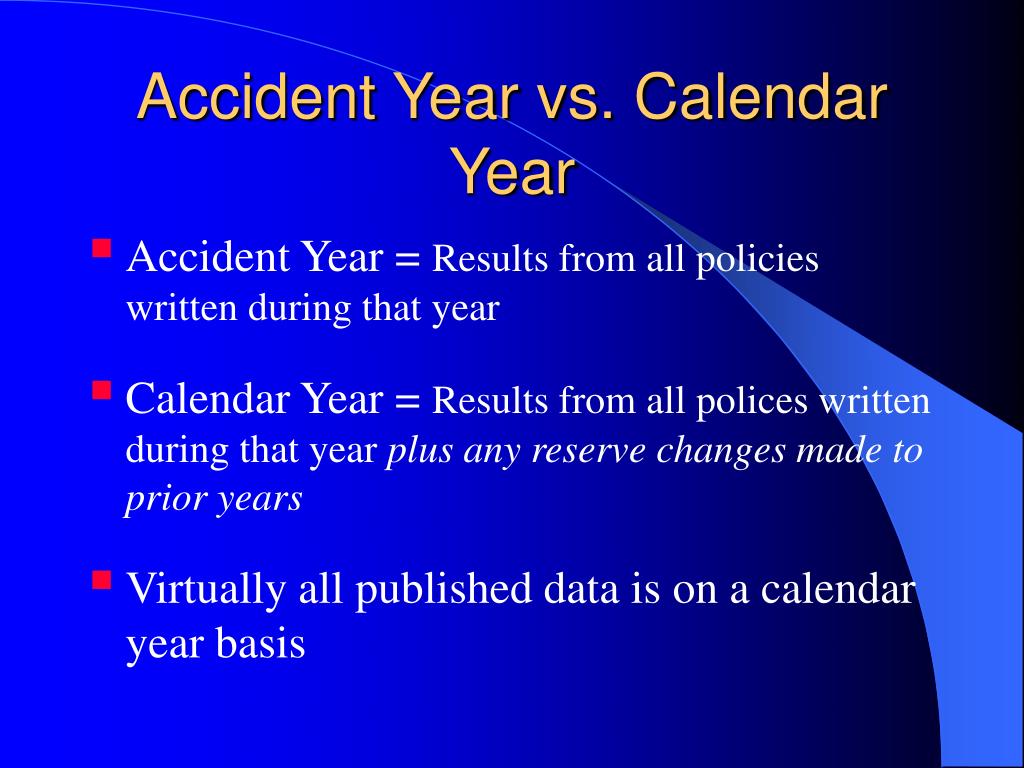

Accident Yr vs. Calendar Yr: Understanding the Essential Distinction in Insurance coverage Accounting

On the earth of insurance coverage, correct accounting is paramount. Understanding how claims are accounted for is essential for insurers to precisely assess their monetary place, handle reserves, and worth future insurance policies successfully. Two elementary strategies dominate this accounting panorama: accident 12 months accounting and calendar 12 months accounting. Whereas each monitor claims, they accomplish that utilizing completely different timeframes, resulting in considerably completely different outcomes and interpretations. This text delves deep into the intricacies of accident 12 months versus calendar 12 months accounting, exploring their methodologies, benefits, disadvantages, and sensible implications for insurers, reinsurers, and in the end, policyholders.

Accident Yr Accounting: Specializing in the Occasion

Accident 12 months accounting focuses on the 12 months through which the insured occasion, or accident, occurred. No matter when the declare is reported, investigated, or settled, it is attributed to the accident 12 months. This strategy supplies a clearer image of the true value of insurance coverage for a particular interval. Think about a automotive accident that occurs in 2023. Even when the declare is not settled till 2025, it is going to be recorded as an accident 12 months loss for 2023. It’s because the occasion that triggered the declare – the accident itself – occurred in 2023.

The Methodology:

Accident 12 months accounting meticulously tracks all claims stemming from accidents that occurred inside a given 12 months. This includes:

- Figuring out the accident date: That is the pivotal level. All associated bills, together with investigation prices, authorized charges, medical bills, and settlements, are assigned to this 12 months.

- Aggregating losses: All claims arising from accidents inside the specified 12 months are aggregated, offering a complete image of the entire incurred losses for that accident 12 months.

- Growing loss reserves: Insurers use actuarial strategies to estimate the last word value of claims associated to a given accident 12 months. This consists of contemplating claims which have been reported however not but settled, in addition to claims which will nonetheless be reported sooner or later (often known as incurred however not reported, or IBNR, claims).

- Analyzing tendencies: By analyzing accident 12 months knowledge over a number of years, insurers can determine tendencies in loss prices, serving to them to higher perceive danger and worth future insurance policies precisely.

Benefits of Accident Yr Accounting:

- Correct reflection of underwriting efficiency: It supplies a real measure of the profitability or lack of a particular underwriting 12 months, isolating the affect of the dangers underwritten throughout that interval. That is essential for assessing the effectiveness of underwriting methods.

- Improved loss reserving: Specializing in the accident 12 months permits for a extra correct estimation of final loss prices, because it instantly hyperlinks bills to the originating occasion. This results in extra dependable reserving practices.

- Higher development evaluation: Accident 12 months knowledge permits for clearer identification of tendencies in loss prices over time, enabling insurers to anticipate future claims and modify pricing accordingly.

- Facilitates reinsurance accounting: Reinsurers usually use accident 12 months accounting to evaluate their publicity to losses and handle their very own reserves successfully.

Disadvantages of Accident Yr Accounting:

- Delayed reporting: The ultimate outcomes for an accident 12 months should not obtainable till all claims associated to that 12 months are settled, which might take a number of years, particularly for legal responsibility claims. This delay can hinder rapid monetary reporting.

- Complexity: Precisely monitoring claims throughout a number of years and estimating IBNR reserves requires refined actuarial methods and important assets.

- Sensitivity to IBNR reserves: The accuracy of the accident 12 months outcomes closely depends on the accuracy of IBNR reserve estimates. Inaccurate estimations can considerably distort the monetary image.

Calendar Yr Accounting: Specializing in the Reporting Interval

Calendar 12 months accounting, in distinction, focuses on the 12 months through which claims are reported, investigated, or paid, no matter when the accident occurred. All claims reported, paid, or incurred throughout a calendar 12 months are aggregated, whatever the accident 12 months. This strategy supplies a extra rapid, although probably much less correct, image of an insurer’s monetary efficiency.

The Methodology:

Calendar 12 months accounting tracks all claims exercise inside a particular calendar 12 months. This consists of:

- Recording claims reported: All claims reported through the 12 months are recorded, whatever the accident date.

- Monitoring declare funds: All declare funds made through the 12 months are recorded, once more whatever the accident date.

- Estimating incurred losses: Insurers estimate the entire incurred losses for the 12 months, together with each paid claims and excellent reserves for reported and unreported claims.

- Analyzing outcomes: The calendar 12 months outcomes provide a snapshot of the insurer’s monetary efficiency throughout that particular calendar 12 months.

Benefits of Calendar Yr Accounting:

- Well timed reporting: Monetary outcomes can be found a lot prior to with accident 12 months accounting, offering a faster overview of the insurer’s monetary efficiency.

- Simplicity: The accounting course of is usually easier than accident 12 months accounting, requiring much less advanced actuarial methods.

- Simpler comparability: Calendar 12 months outcomes are simpler to check throughout completely different years, providing a simple view of year-over-year adjustments.

Disadvantages of Calendar Yr Accounting:

- Distorted underwriting efficiency: It does not precisely mirror the underwriting efficiency of a particular 12 months, as claims from a number of accident years are combined collectively.

- Much less dependable loss reserving: Estimating reserves is more difficult as a result of the information isn’t instantly linked to the accident 12 months. This may result in much less correct predictions of final losses.

- Troublesome development evaluation: Analyzing tendencies in loss prices is extra advanced, as the information displays a mixture of claims from completely different accident years.

- Restricted usefulness for reinsurance: Calendar 12 months accounting is much less helpful for reinsurers, who have to assess their publicity primarily based on the accident 12 months.

Selecting the Proper Method: A Matter of Perspective

The selection between accident 12 months and calendar 12 months accounting is determined by the precise wants and objectives. Accident 12 months accounting is most popular for:

- Lengthy-term monetary planning and evaluation: It supplies a extra correct reflection of underwriting efficiency over time.

- Loss reserving and capital modeling: It allows extra correct estimation of final loss prices.

- Reinsurance accounting: It’s important for correct evaluation of reinsurance publicity.

Calendar 12 months accounting is extra appropriate for:

- Quick-term monetary reporting: It supplies a fast overview of the insurer’s monetary efficiency.

- Regulatory reporting: Some regulatory our bodies could require calendar 12 months reporting for sure functions.

- Inner administration reporting: It may be used for inside monitoring of operational effectivity.

Conclusion:

Each accident 12 months and calendar 12 months accounting serve vital functions within the insurance coverage trade. Understanding the variations between these two strategies is essential for deciphering monetary statements and making knowledgeable choices. Whereas calendar 12 months accounting gives rapid insights, accident 12 months accounting supplies a extra correct and insightful view of long-term underwriting efficiency and loss tendencies. Insurers, reinsurers, and analysts want to grasp each approaches and make the most of the suitable methodology relying on the context and their particular targets. The last word aim is to precisely assess danger, handle reserves successfully, and make sure the long-term monetary stability of the insurance coverage trade. By using each methodologies strategically, a complete understanding of the insurance coverage enterprise could be achieved.

Closure

Thus, we hope this text has offered invaluable insights into accident 12 months vs calendar 12 months. We hope you discover this text informative and useful. See you in our subsequent article!