Navigating The 2025 Semi-Month-to-month Payroll Calendar: A Complete Information For Employers And Staff

By admin / November 21, 2024 / No Comments / 2025

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information for Employers and Staff

Associated Articles: Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information for Employers and Staff

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information for Employers and Staff. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information for Employers and Staff

The yr 2025 is quick approaching, and with it comes the necessity for meticulous planning, particularly for companies managing payroll. A semi-monthly payroll schedule, paying workers twice a month, requires cautious consideration of holidays, weekends, and the general calendar construction to make sure well timed and correct compensation. This complete information delves into the intricacies of the 2025 semi-monthly payroll calendar, offering beneficial insights for each employers and workers.

Understanding the Semi-Month-to-month Payroll System:

In contrast to bi-weekly payroll (paid each two weeks), semi-monthly payroll entails paying workers on two particular days of the month, usually the fifteenth and the final day of the month. This technique affords a number of benefits, together with:

- Constant Pay Dates: Staff obtain their paychecks on predictable dates, facilitating higher budgeting and monetary planning.

- Simplified Accounting: The constant pay durations simplify accounting processes and scale back the executive burden.

- Improved Money Stream Administration: For companies, the predictable fee schedule aids in higher money circulate administration.

Nevertheless, the semi-monthly system additionally presents challenges:

- Various Pay Intervals: The variety of days between pay durations fluctuates all year long as a result of various variety of days in every month. This necessitates cautious calculation of pay for every interval.

- Vacation Concerns: Holidays falling close to the fifteenth or the top of the month require changes to the payroll schedule.

The 2025 Semi-Month-to-month Payroll Calendar: A Detailed Look

To create a complete 2025 semi-monthly payroll calendar, we have to think about the next:

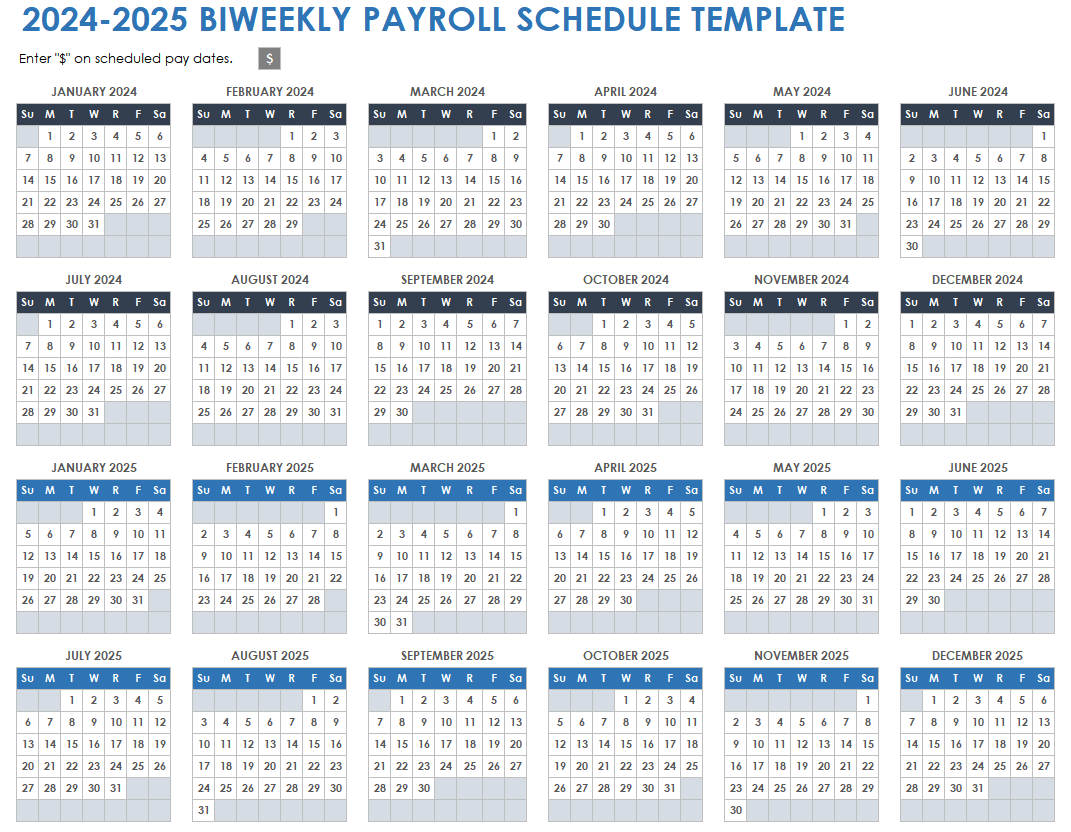

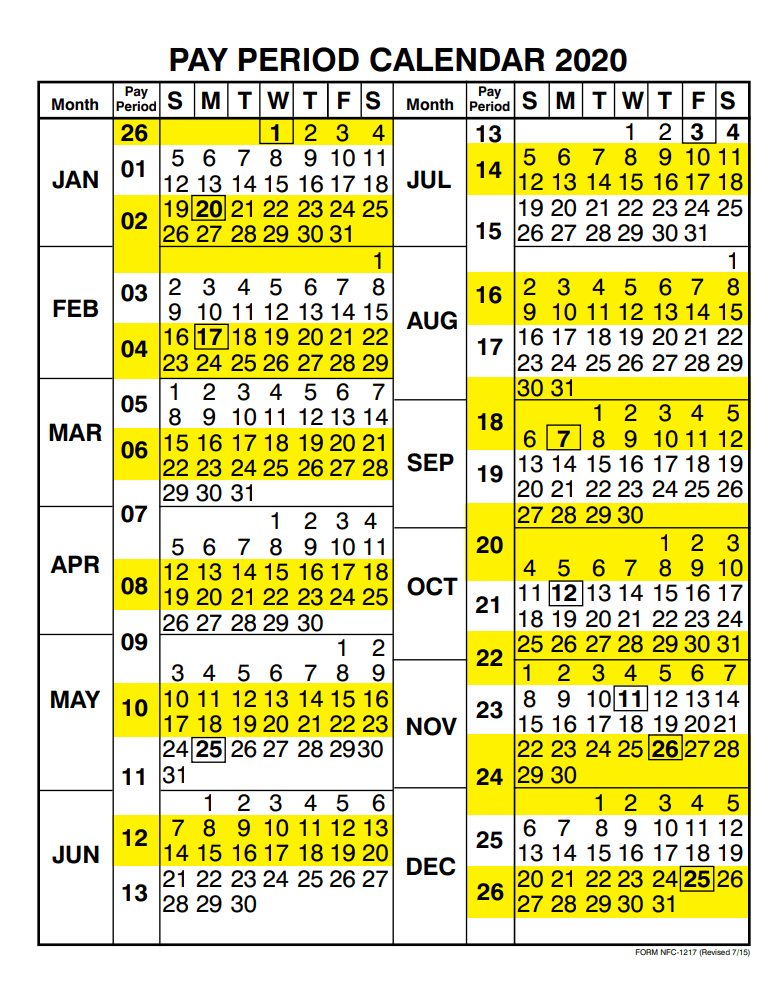

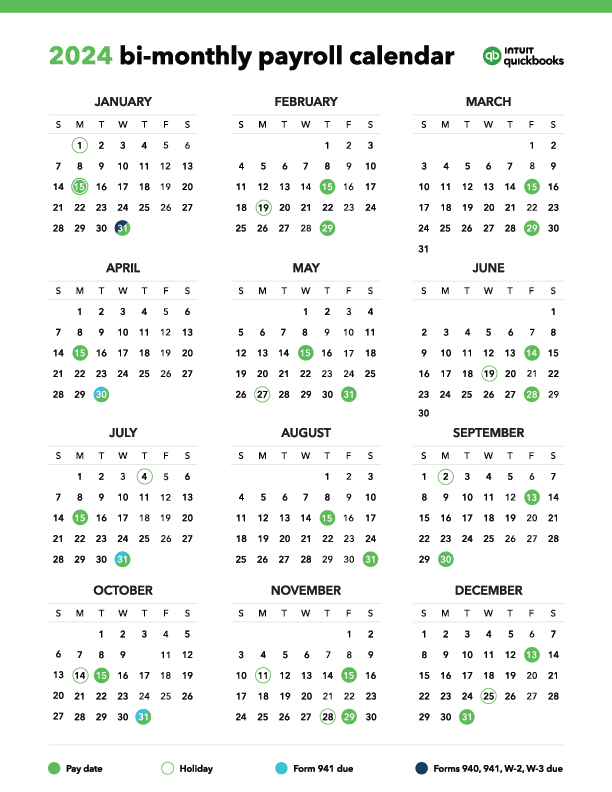

- Pay Intervals: Every month could have two pay durations.

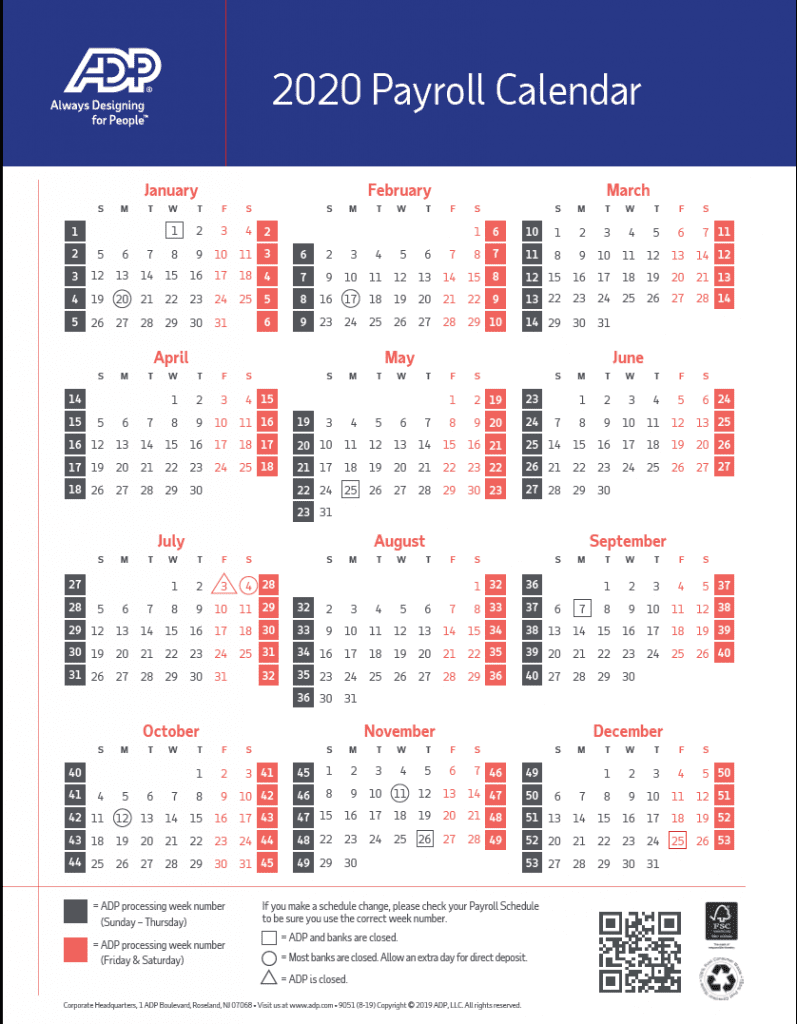

- Pay Dates: These are usually the fifteenth and the final day of the month. Nevertheless, changes could also be obligatory attributable to weekends or holidays.

- Holidays: Federal holidays and any company-specific holidays have to be factored into the schedule. This usually necessitates shifting pay dates to keep away from paying workers on a non-working day.

- Weekend Changes: If the fifteenth or the final day of the month falls on a weekend, the pay date will probably be shifted to the previous Friday.

2025 Federal Holidays & Their Impression:

The next are the 2025 Federal holidays in the USA. Their proximity to the fifteenth or the top of the month will dictate any obligatory payroll date changes:

- New Yr’s Day: January 1st (Wednesday) – Doubtless no affect on pay dates.

- Martin Luther King, Jr. Day: January twentieth (Monday) – Doubtless no affect on pay dates.

- Presidents’ Day: February seventeenth (Monday) – Doubtless no affect on pay dates.

- Memorial Day: Could twenty sixth (Monday) – Could require adjustment if the final day of Could falls near this date.

- Juneteenth Nationwide Independence Day: June nineteenth (Thursday) – Could require adjustment if the final day of June falls near this date.

- Independence Day: July 4th (Friday) – Doubtless requires adjustment for the July pay interval.

- Labor Day: September 1st (Monday) – Doubtless no affect on pay dates.

- Columbus Day: October thirteenth (Monday) – Doubtless no affect on pay dates.

- Veterans Day: November eleventh (Tuesday) – Doubtless no affect on pay dates.

- Thanksgiving Day: November twenty seventh (Thursday) – Could require adjustment if the final day of November falls near this date.

- Christmas Day: December twenty fifth (Thursday) – Doubtless requires adjustment for the December pay interval.

Pattern 2025 Semi-Month-to-month Payroll Calendar (Illustrative):

This can be a pattern calendar and should require changes primarily based in your particular firm insurance policies and any state or native holidays. All the time seek the advice of with payroll professionals to make sure accuracy.

| Month | Pay Interval 1 (approx.) | Pay Interval 2 (approx.) | Notes |

|---|---|---|---|

| January | January fifteenth | January thirty first | |

| February | February 14th | February twenty eighth | |

| March | March fifteenth | March thirty first | |

| April | April fifteenth | April thirtieth | |

| Could | Could fifteenth | Could twenty ninth (or thirtieth) | Adjusted for Memorial Day |

| June | June fifteenth | June thirtieth (or twenty seventh) | Adjusted for Juneteenth |

| July | July fifteenth | July thirty first (or thirtieth) | Adjusted for Independence Day |

| August | August fifteenth | August thirty first | |

| September | September fifteenth | September thirtieth | |

| October | October fifteenth | October thirty first | |

| November | November fifteenth | November twenty eighth | Adjusted for Thanksgiving |

| December | December fifteenth | December thirty first (or thirtieth) | Adjusted for Christmas |

Greatest Practices for Managing Semi-Month-to-month Payroll:

- Make the most of Payroll Software program: Investing in dependable payroll software program streamlines the method, automating calculations and lowering errors.

- Repeatedly Evaluate the Calendar: Keep forward of the curve by often reviewing the payroll calendar, particularly round holidays, to make sure well timed funds.

- Talk Clearly with Staff: Hold workers knowledgeable of any modifications or changes to the payroll schedule.

- Preserve Correct Information: Meticulous record-keeping is essential for compliance and correct tax reporting.

- Seek the advice of Payroll Professionals: Search skilled recommendation to make sure compliance with all related legal guidelines and laws.

Worker Concerns:

Staff ought to:

- Perceive the Pay Schedule: Familiarize themselves with the corporate’s semi-monthly payroll schedule.

- Price range Accordingly: Plan their funds primarily based on the constant pay dates.

- Contact HR for Clarification: Attain out to the HR division if they’ve any questions or issues relating to their pay.

Conclusion:

The 2025 semi-monthly payroll calendar requires cautious planning and execution. By understanding the intricacies of the system, using applicable instruments, and sustaining clear communication, each employers and workers can navigate the yr easily. Keep in mind that this information supplies a normal framework. All the time seek the advice of with payroll professionals and consult with particular firm insurance policies and related laws to make sure correct and compliant payroll processing all through 2025. Proactive planning and a focus to element are key to a profitable payroll yr.

Closure

Thus, we hope this text has supplied beneficial insights into Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information for Employers and Staff. We respect your consideration to our article. See you in our subsequent article!