Navigating The 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

By admin / May 1, 2024 / No Comments / 2025

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Associated Articles: Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

The 12 months 2025 is quick approaching, and with it comes the necessity for meticulous planning, particularly for companies dealing with payroll. A well-organized payroll calendar is essential for making certain well timed and correct compensation for workers, sustaining compliance with labor legal guidelines, and stopping potential monetary complications. This text delves deep into creating and using a 2025 semi-monthly payroll calendar, offering templates, greatest practices, and beneficial insights to streamline your payroll course of.

Understanding Semi-Month-to-month Payroll

Semi-monthly payroll, versus bi-weekly, means workers are paid twice a month, sometimes on the fifteenth and the final day of the month. This technique affords a number of benefits, together with constant paydays and easier accounting, however it additionally requires cautious consideration of various month lengths and potential vacation shifts.

Constructing Your 2025 Semi-Month-to-month Payroll Calendar: A Step-by-Step Information

Making a 2025 semi-monthly payroll calendar includes extra than simply marking the fifteenth and final day of every month. A number of elements should be thought of to make sure accuracy and compliance:

-

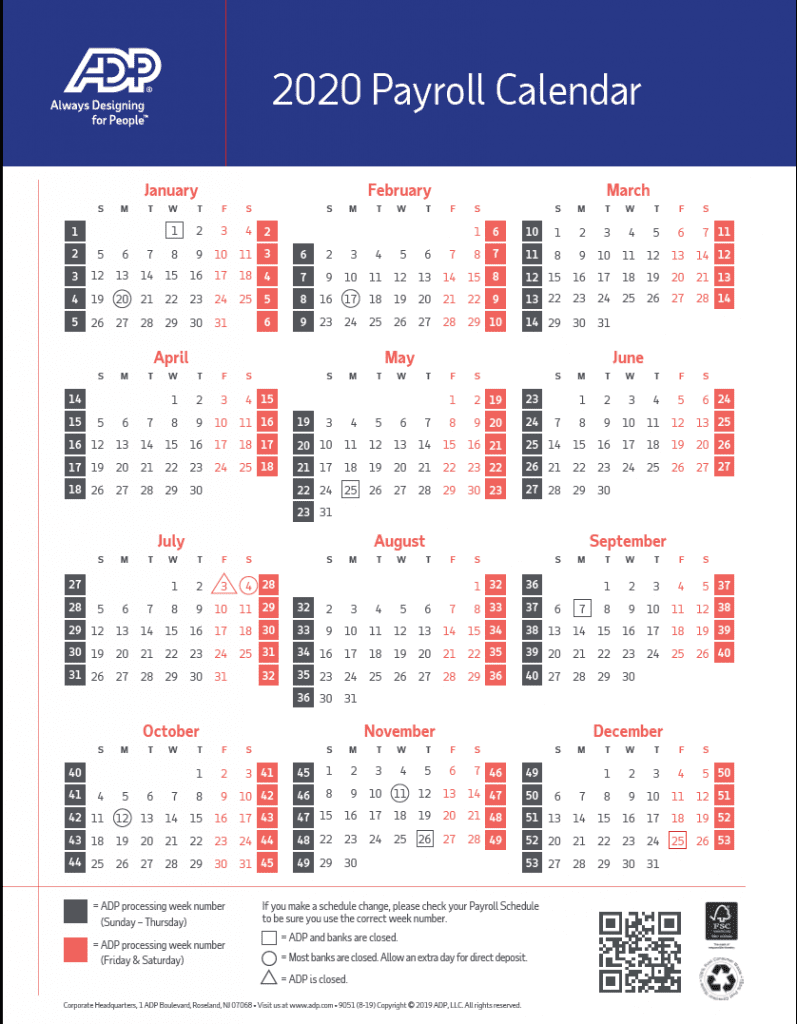

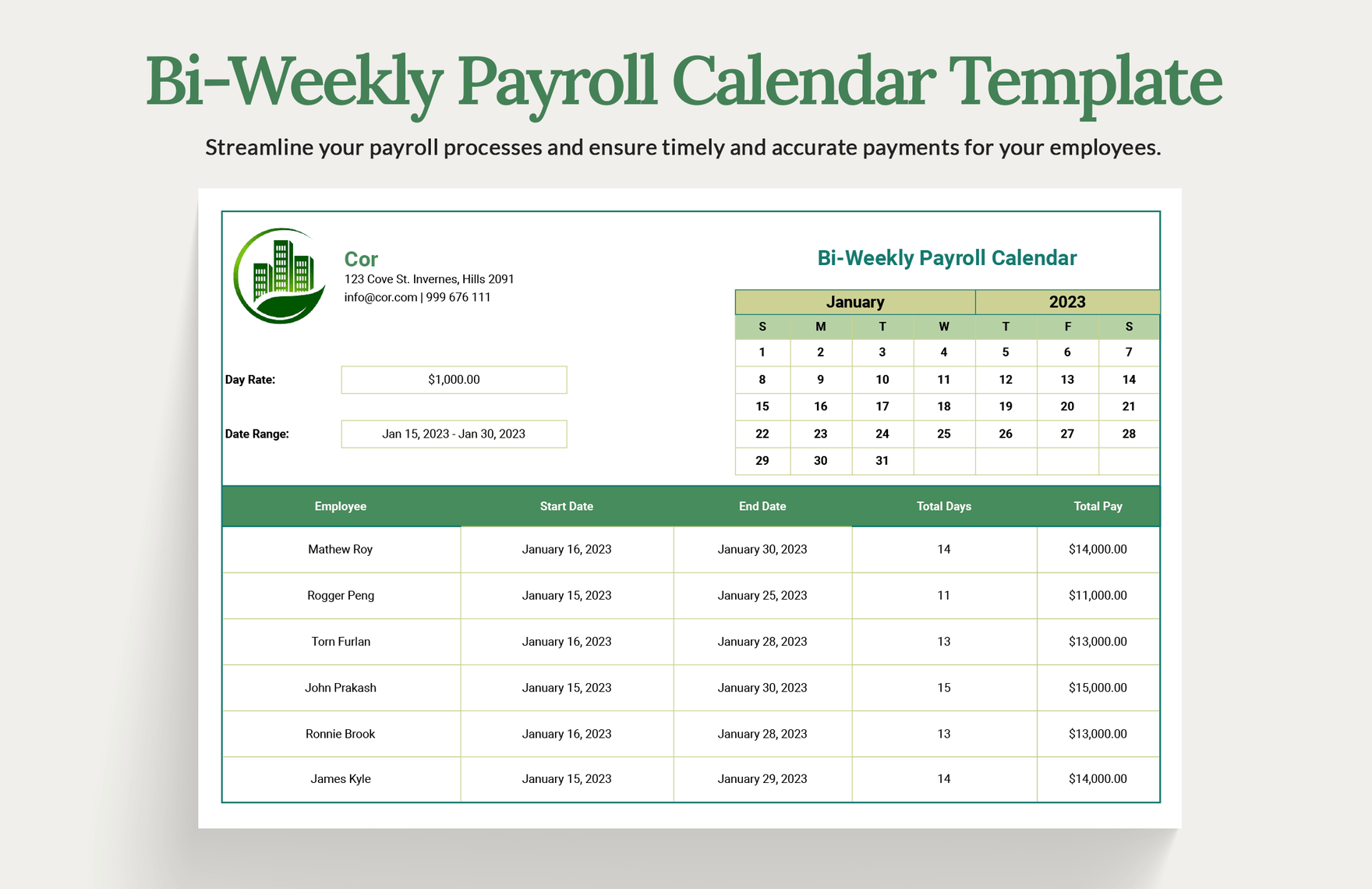

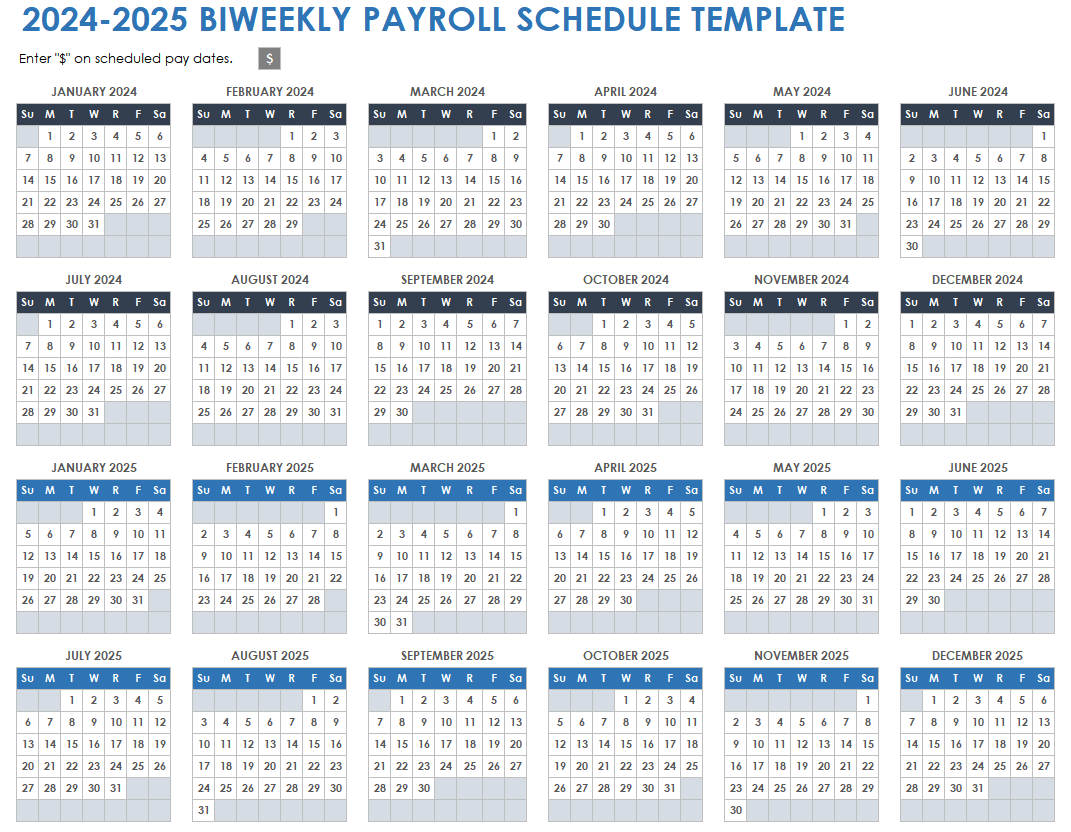

Selecting a Calendar Format: You may go for a easy desk format in a spreadsheet program like Microsoft Excel or Google Sheets, or use specialised payroll software program. A spreadsheet affords flexibility and customization, whereas payroll software program typically integrates with different enterprise methods for streamlined processing.

-

Figuring out Pay Durations: Clearly outline every pay interval. For semi-monthly payroll, every pay interval spans roughly two weeks. Quantity every pay interval sequentially all year long for straightforward reference.

-

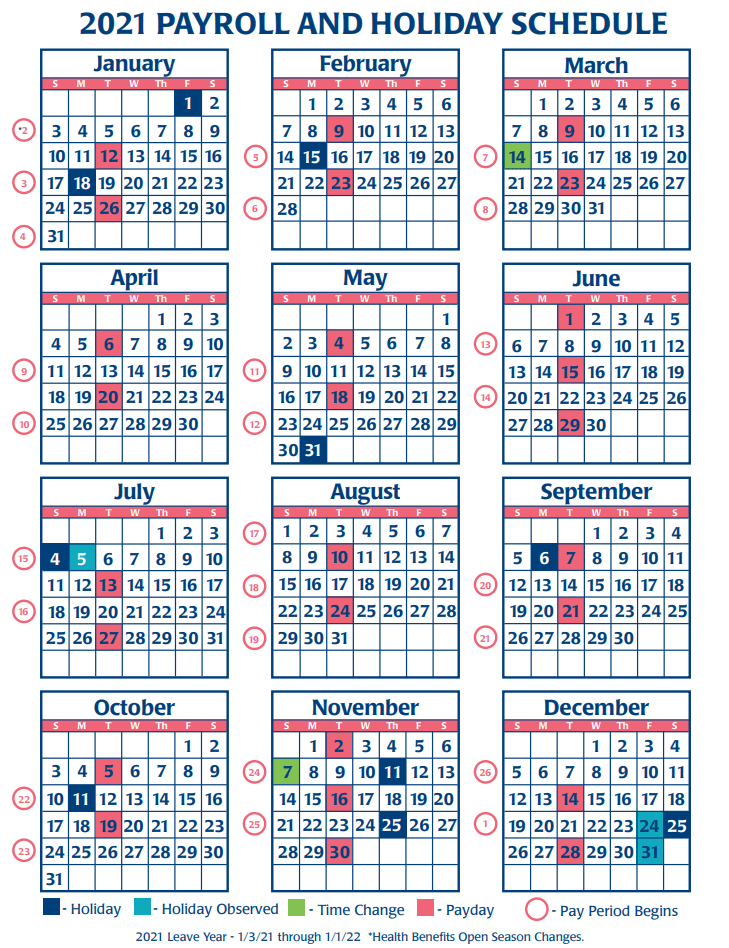

Marking Paydays: Enter the particular paydays for every interval. For semi-monthly payroll in 2025, it will typically be the fifteenth and the final day of every month. Nonetheless, you will want to regulate for weekends and holidays.

-

Accounting for Holidays: That is essential. If a payday falls on a weekend or vacation, it’s essential to decide whether or not to pay workers early or late. Your organization coverage ought to dictate this. Clearly point out any holiday-related shifts on the calendar. Think about using totally different colours or highlighting to emphasise these changes.

-

Together with Vital Dates: Incorporate different related dates, reminiscent of tax deadlines, advantages enrollment intervals, and efficiency overview schedules. This holistic strategy helps keep a complete overview of your HR and monetary obligations.

-

Including Notes and Reminders: Go away area for notes and reminders. This might embrace deadlines for submitting payroll information, reminders for annual tax filings, or notes on any uncommon pay changes.

Pattern 2025 Semi-Month-to-month Payroll Calendar Template (Excel/Spreadsheet)

The next desk represents a simplified template. Bear in mind to regulate it primarily based in your firm’s particular insurance policies and the 2025 calendar:

| Pay Interval | Begin Date | Finish Date | Payday 1 | Payday 2 | Notes |

|---|---|---|---|---|---|

| 1 | January 1, 2025 | January 15, 2025 | January 15, 2025 | ||

| 2 | January 16, 2025 | January 31, 2025 | January 31, 2025 | ||

| 3 | February 1, 2025 | February 15, 2025 | February 15, 2025 | ||

| 4 | February 16, 2025 | February 28, 2025 | February 28, 2025 | ||

| 5 | March 1, 2025 | March 15, 2025 | March 15, 2025 | ||

| 6 | March 16, 2025 | March 31, 2025 | March 31, 2025 | ||

| … | … | … | … | … | … |

| 24 | December 16, 2025 | December 31, 2025 | December 31, 2025 | 12 months-end tax preparations |

Addressing Vacation and Weekend Paydays

Dealing with paydays that fall on weekends or holidays requires a transparent firm coverage. Widespread approaches embrace:

- Paying early: Distribute funds on the previous Friday if the payday falls on a weekend or vacation.

- Paying late: Distribute funds on the next Monday if the payday falls on a weekend or vacation.

- Constant payday: Keep a constant payday whatever the day of the week, even when it means paying on a weekend or vacation.

Your chosen technique needs to be clearly communicated to workers and constantly utilized all year long. The calendar ought to mirror the chosen strategy.

Integrating with Payroll Software program

Many payroll software program options automate the creation and administration of payroll calendars. These packages typically supply options reminiscent of:

- Computerized vacation changes: The software program mechanically adjusts paydays primarily based on holidays.

- Tax calculation and reporting: Simplified tax calculation and reporting options.

- Direct deposit integration: Streamlined direct deposit processing.

- Time and attendance monitoring: Integration with time and attendance methods for correct payroll information.

Authorized Compliance and Greatest Practices

Sustaining a compliant payroll calendar is important. Failure to adjust to labor legal guidelines may end up in important penalties. Key concerns embrace:

- Federal and state laws: Familiarize your self with all relevant federal and state legal guidelines concerning payroll, together with minimal wage, time beyond regulation pay, and tax withholding necessities.

- Correct record-keeping: Keep meticulous data of all payroll transactions, together with pay stubs, tax varieties, and different related documentation.

- Worker communication: Clearly talk the payroll schedule to workers and promptly tackle any questions or considerations.

- Common audits: Conduct common audits of your payroll processes to make sure accuracy and compliance.

Conclusion

A well-structured 2025 semi-monthly payroll calendar is an indispensable software for any enterprise. By following the steps outlined above and using acceptable software program or spreadsheet templates, you’ll be able to guarantee well timed and correct payroll processing, minimizing administrative burdens and sustaining compliance with all related laws. Do not forget that proactive planning and a spotlight to element are key to a easy and environment friendly payroll course of all year long. Usually overview and replace your calendar to accommodate any adjustments in firm coverage or authorized necessities. This proactive strategy will contribute considerably to a profitable and stress-free 2025 for your corporation.

Closure

Thus, we hope this text has offered beneficial insights into Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. We admire your consideration to our article. See you in our subsequent article!