Navigating The 2025 Small Enterprise Tax Calendar: A Complete Information

By admin / September 14, 2024 / No Comments / 2025

Navigating the 2025 Small Enterprise Tax Calendar: A Complete Information

Associated Articles: Navigating the 2025 Small Enterprise Tax Calendar: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the 2025 Small Enterprise Tax Calendar: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Small Enterprise Tax Calendar: A Complete Information

The 2025 tax 12 months will current a novel set of challenges and alternatives for small enterprise homeowners. Staying organized and adhering to the tax calendar is essential for minimizing penalties, maximizing deductions, and guaranteeing easy monetary operations. This complete information breaks down the important thing tax deadlines and concerns for small companies in 2025, serving to you navigate the complexities of tax compliance.

Understanding Your Enterprise Construction:

Earlier than diving into the calendar, it is essential to know what you are promoting construction. Your tax obligations differ considerably relying on whether or not you use as a sole proprietorship, partnership, LLC, S company, or C company. Every construction has totally different submitting necessities and tax types. Consulting with a tax skilled is very really helpful to find out the optimum construction for what you are promoting and to make sure you’re using probably the most advantageous tax methods.

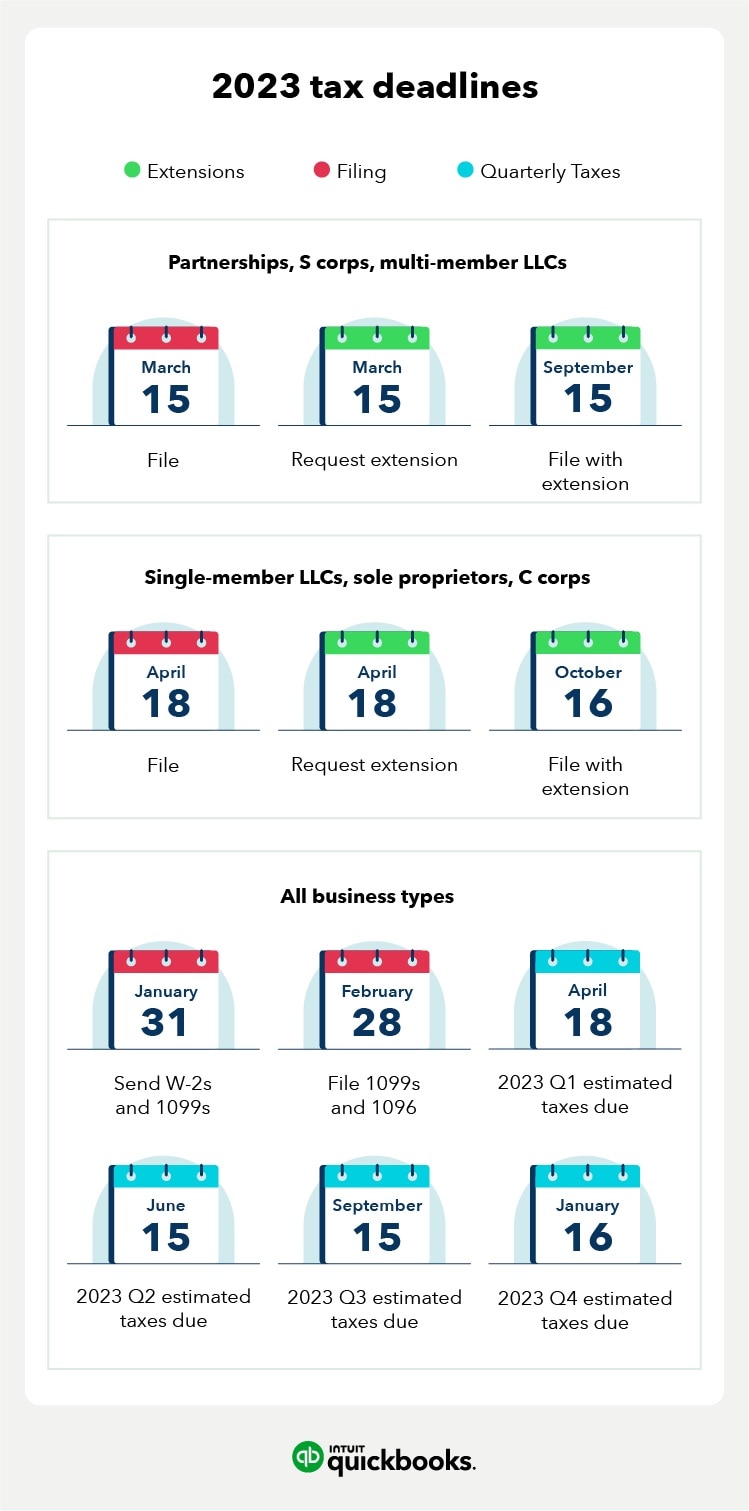

Key Tax Deadlines for 2025 (Preliminary – All the time confirm with the IRS):

The IRS sometimes releases the official tax calendar in late summer time or early fall of the previous 12 months. The dates beneath are projections based mostly on earlier years’ calendars and are topic to vary. All the time seek the advice of the official IRS web site for probably the most up-to-date data.

Notice: These dates are for the 2025 tax 12 months (earnings earned in 2025), which shall be filed in 2026.

-

January 15, 2026: Estimated tax funds for the fourth quarter of 2025 are due for self-employed people and companies that pay estimated taxes. This is applicable to those that aren’t having taxes withheld from their paychecks.

-

January 31, 2026: This date is important for numerous reporting necessities, together with:

- Kind 1099-NEC (Non-Worker Compensation): For those who paid impartial contractors or freelancers $600 or extra throughout 2025, you will need to file Kind 1099-NEC by this date. Failure to take action can lead to important penalties.

- Kind W-2 (Wage and Tax Assertion): For those who make use of people, you will need to file Kind W-2 with the Social Safety Administration (SSA) and supply copies to your staff by this date.

- Kind 1099-MISC (Miscellaneous Revenue): Whereas the first use of 1099-NEC has outmoded many makes use of of 1099-MISC, some funds, equivalent to hire or royalties, should require this way. Verify the IRS pointers to find out if this is applicable to what you are promoting.

-

April 15, 2026: That is the standard tax submitting deadline for many small companies. This date applies to:

- Sole Proprietorships: File Schedule C (Revenue or Loss from Enterprise) with Kind 1040.

- Partnerships: File Kind 1065 (U.S. Return of Partnership Revenue).

- S Companies: File Kind 1120-S (U.S. Revenue Tax Return for an S Company).

- LLCs taxed as sole proprietorships, partnerships, or S firms: File the suitable return based mostly on their tax classification.

-

June 15, 2026: That is the deadline for requesting an automated six-month extension to file your tax return. Notice: An extension to file doesn’t grant an extension to pay. You could nonetheless estimate and pay your taxes by April fifteenth to keep away from penalties.

-

October 15, 2026: That is the deadline for submitting your tax return should you obtained an automated six-month extension. Once more, estimated taxes ought to have been paid by April fifteenth.

Quarterly Estimated Tax Funds:

Many small enterprise homeowners are required to make estimated tax funds all year long. That is sometimes needed should you anticipate owing important taxes and do not have sufficient withheld from different sources (like a W-2 job). Estimated taxes are normally paid quarterly, with deadlines falling on:

- April 15, 2025

- June 15, 2025

- September 15, 2025

- January 15, 2026 (for the fourth quarter of 2025)

Vital Tax Concerns for Small Companies in 2025:

- Tax Reform and Modifications: Keep up to date on any potential tax regulation modifications which will affect what you are promoting. The tax panorama can shift, so steady monitoring is essential.

-

Deductions and Credit: Familiarize your self with accessible deductions and credit for small companies. These can considerably cut back your tax legal responsibility. Examples embrace:

- Certified Enterprise Revenue (QBI) Deduction: This deduction can considerably cut back your taxable earnings.

- House Workplace Deduction: For those who use a portion of your house solely and often for enterprise, you could possibly deduct bills associated to that area.

- Self-Employment Tax Deduction: A deduction for one-half of your self-employment tax.

- File Protecting: Meticulous record-keeping is paramount. Keep correct information of all earnings and bills, together with receipts, invoices, financial institution statements, and different related documentation. This may simplify the tax preparation course of and assist keep away from potential audits.

- Payroll Taxes: For those who make use of others, perceive your obligations concerning payroll taxes, together with Social Safety, Medicare, and federal and state unemployment taxes. Correct and well timed fee is vital.

- State and Native Taxes: Keep in mind that along with federal taxes, you will probably have state and native tax obligations. These differ extensively relying in your location.

- Gross sales Tax: If what you are promoting is topic to gross sales tax, perceive the submitting necessities and deadlines in your state.

Using Expertise and Skilled Assist:

- Tax Software program: Think about using tax software program designed for small companies. These packages may help streamline the tax preparation course of and cut back errors.

- Cloud-Based mostly Accounting: Cloud-based accounting software program may help you monitor earnings and bills in real-time, making tax preparation a lot simpler.

- Tax Professionals: Partaking a certified tax skilled, equivalent to a CPA or enrolled agent, can present invaluable help in navigating the complexities of small enterprise taxes. They may help you optimize your tax technique, guarantee compliance, and signify you in case of an audit.

Planning for the Future:

Do not wait till the final minute to deal with your tax obligations. Begin planning early within the 12 months to make sure you have the required information and data available. Usually evaluation your monetary information and seek the advice of together with your tax advisor to proactively tackle any potential tax points.

Disclaimer: This text gives basic data and shouldn’t be thought of skilled tax recommendation. The knowledge supplied is predicated on projections and should change. All the time seek the advice of with a certified tax skilled for personalised recommendation tailor-made to your particular enterprise circumstances. The IRS web site is the definitive supply for all tax-related data and deadlines.

Closure

Thus, we hope this text has supplied helpful insights into Navigating the 2025 Small Enterprise Tax Calendar: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!