Navigating The 2025 Tax Panorama: A Complete Due Date Calendar And Planning Information

By admin / September 20, 2024 / No Comments / 2025

Navigating the 2025 Tax Panorama: A Complete Due Date Calendar and Planning Information

Associated Articles: Navigating the 2025 Tax Panorama: A Complete Due Date Calendar and Planning Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Navigating the 2025 Tax Panorama: A Complete Due Date Calendar and Planning Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Tax Panorama: A Complete Due Date Calendar and Planning Information

The yr 2025 is quickly approaching, and with it comes the acquainted process of tax preparation and submitting. Understanding the deadlines and intricacies of the tax system is essential for people and companies alike to keep away from penalties and guarantee compliance. This complete information supplies an in depth 2025 tax due date calendar, encompassing varied tax obligations, and presents priceless insights into efficient tax planning methods. Whereas particular tax legal guidelines are topic to alter, this text supplies a normal overview based mostly on present rules. At all times seek the advice of with a professional tax skilled for personalised recommendation.

Understanding the Tax 12 months and Submitting Deadlines:

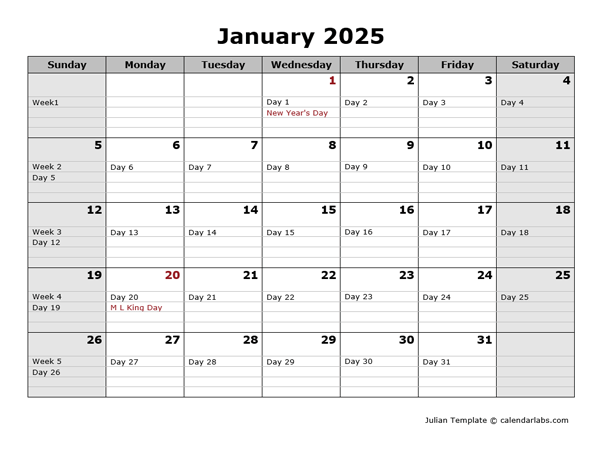

The tax yr in most jurisdictions usually runs from January 1st to December thirty first. Due to this fact, the 2025 tax yr refers back to the interval from January 1, 2025, to December 31, 2025. The submitting deadlines for particular person and enterprise taxes are typically mounted, however sure circumstances can warrant extensions.

2025 Tax Due Date Calendar: A Preliminary Overview

Please observe: This calendar is a preliminary overview and doesn’t embody each doable tax submitting deadline. Particular dates could differ relying in your jurisdiction and tax scenario. At all times discuss with official authorities sources for correct and up-to-date info.

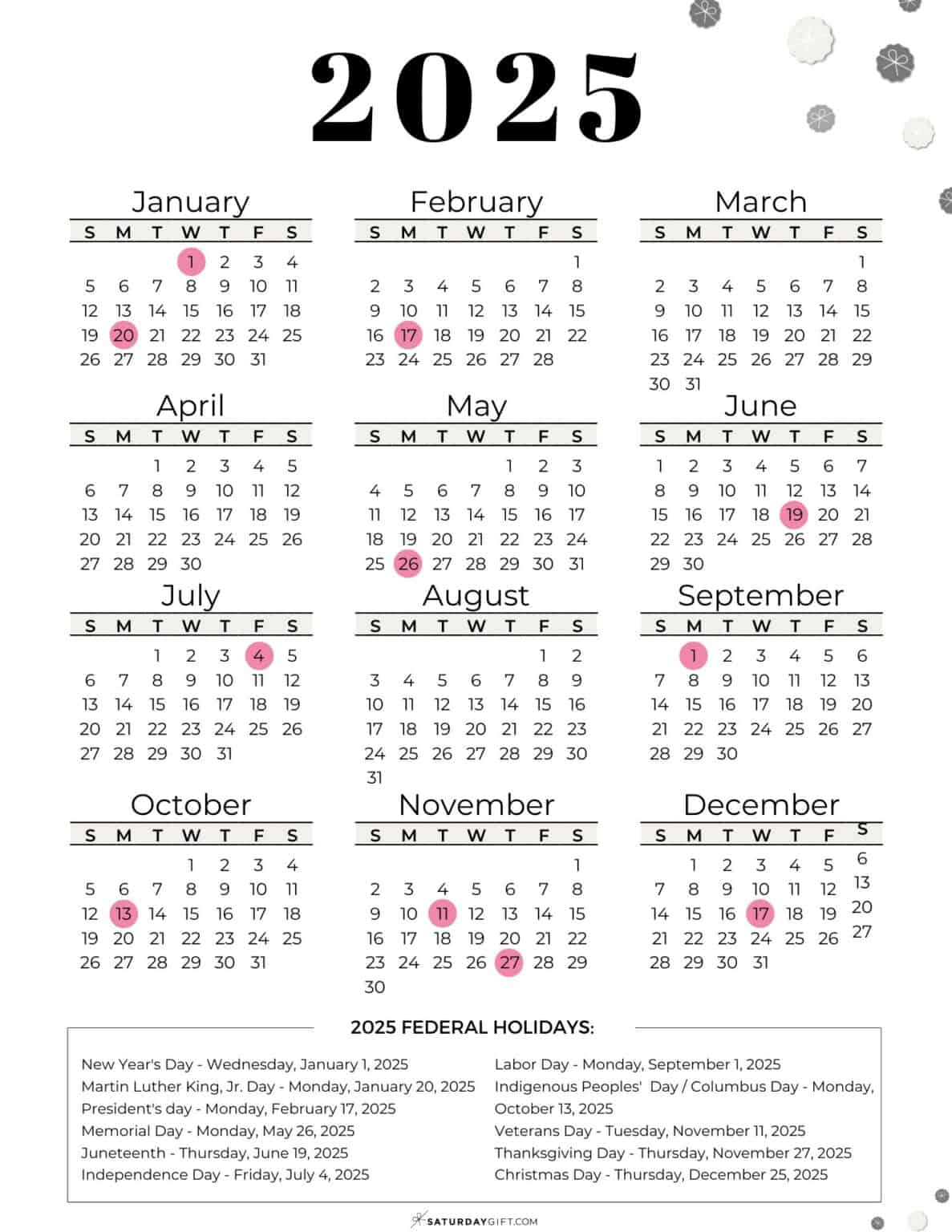

Key Dates (Topic to Change):

-

Estimated Tax Funds (People & Companies): Quarterly estimated tax funds are usually due on April fifteenth, June fifteenth, September fifteenth, and January fifteenth of the next yr. These funds are essential for self-employed people, freelancers, and people with important earnings from sources apart from employment wages. Failure to pay estimated taxes can lead to penalties.

-

Particular person Revenue Tax Submitting Deadline: The first deadline for submitting particular person earnings tax returns is usually April fifteenth, 2026 (for the 2025 tax yr). This deadline applies to each paper and electronically filed returns.

-

Enterprise Tax Submitting Deadlines: Deadlines for enterprise taxes differ significantly relying on the kind of enterprise entity (sole proprietorship, partnership, LLC, company, and many others.) and the precise tax kinds required. Widespread deadlines embrace:

- Partnership Returns (Kind 1065): Sometimes March fifteenth, 2026.

- Company Returns (Kind 1120): Sometimes March fifteenth, 2026.

- S Company Returns (Kind 1120-S): Sometimes March fifteenth, 2026.

-

Extension Deadlines: Taxpayers can typically request an computerized extension to file their tax returns. This extension usually grants a further six months to file, however it doesn’t prolong the deadline for paying taxes. The extension request have to be filed by the unique due date.

-

State Tax Deadlines: State tax deadlines differ extensively. Every state has its personal tax legal guidelines and submitting necessities. It is important to verify your state’s tax company web site for particular deadlines.

Detailed Breakdown of Tax Obligations:

The 2025 tax yr will possible contain a spread of tax obligations, together with:

-

Federal Revenue Tax: That is the first tax levied on particular person earnings, together with wages, salaries, funding earnings, and enterprise income. The tax charge is progressive, which means greater earners pay a bigger proportion of their earnings in taxes.

-

State Revenue Tax: Most states impose their very own earnings taxes, with charges and rules differing considerably.

-

Payroll Taxes: Employers are liable for withholding and remitting payroll taxes, together with Social Safety and Medicare taxes, from worker wages. Self-employed people additionally pay self-employment taxes.

-

Gross sales Tax: Gross sales tax is levied on the sale of products and companies in most states. Companies accumulating gross sales tax are liable for remitting it to the state.

-

Property Tax: Property tax is a tax on actual property and is usually levied by native governments.

-

Property and Present Taxes: These taxes apply to the switch of great belongings upon demise or throughout life.

-

Different Taxes: Relying in your circumstances, you would possibly encounter different tax obligations, corresponding to excise taxes, environmental taxes, or different specialised taxes.

Efficient Tax Planning Methods for 2025:

Proactive tax planning can considerably scale back your general tax burden. Think about these methods:

-

Maximize Deductions and Credit: Familiarize your self with accessible deductions and credit, corresponding to these for charitable contributions, training bills, and dependent care. Correct record-keeping is essential for claiming these deductions.

-

Retirement Planning: Contributions to certified retirement plans, like 401(okay)s and IRAs, are sometimes tax-deductible, lowering your taxable earnings.

-

Funding Methods: Think about tax-advantaged funding choices, corresponding to municipal bonds, which regularly supply tax-exempt curiosity earnings.

-

Tax Loss Harvesting: Offsetting capital positive factors with capital losses can scale back your general tax legal responsibility.

-

Common Tax Funds: Making well timed estimated tax funds avoids penalties and curiosity fees.

-

Skilled Tax Recommendation: Seek the advice of with a professional tax skilled to debate your particular tax scenario and develop a customized tax plan. They will help you navigate advanced tax legal guidelines and optimize your tax technique.

Avoiding Penalties and Curiosity:

Failing to satisfy tax deadlines or precisely report your earnings can lead to important penalties and curiosity fees. These penalties can shortly accumulate, considerably impacting your monetary scenario. To keep away from these penalties:

-

Maintain Correct Data: Keep meticulous data of all earnings and bills all year long.

-

File on Time: Submit your tax returns by the designated deadline or acquire a well timed extension.

-

Pay on Time: Guarantee all tax funds are made by the due date.

-

Perceive Tax Legal guidelines: Keep knowledgeable about modifications in tax legal guidelines and rules.

Conclusion:

Navigating the 2025 tax panorama requires cautious planning and a spotlight to element. This text supplies a preliminary overview of key due dates and tax obligations. Nonetheless, it is essential to keep in mind that tax legal guidelines are advanced and topic to alter. At all times seek the advice of with a professional tax skilled for personalised recommendation tailor-made to your particular circumstances. By proactively planning and staying knowledgeable, you possibly can guarantee compliance, decrease your tax legal responsibility, and keep away from potential penalties. Bear in mind to discuss with official authorities web sites and assets for probably the most correct and up-to-date info relating to 2025 tax deadlines and rules. Proactive planning is the important thing to a profitable and stress-free tax season.

Closure

Thus, we hope this text has supplied priceless insights into Navigating the 2025 Tax Panorama: A Complete Due Date Calendar and Planning Information. We hope you discover this text informative and useful. See you in our subsequent article!