Navigating The New Jersey Payroll Calendar 2025: A Complete Information For Employers And Staff

By admin / November 6, 2024 / No Comments / 2025

Navigating the New Jersey Payroll Calendar 2025: A Complete Information for Employers and Staff

Associated Articles: Navigating the New Jersey Payroll Calendar 2025: A Complete Information for Employers and Staff

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Navigating the New Jersey Payroll Calendar 2025: A Complete Information for Employers and Staff. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the New Jersey Payroll Calendar 2025: A Complete Information for Employers and Staff

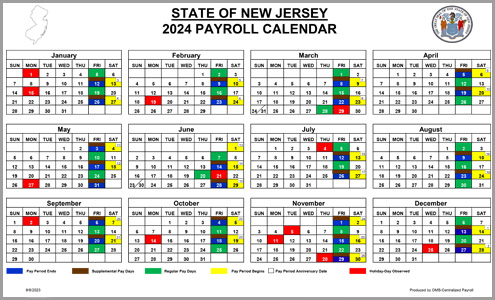

The New Jersey payroll calendar for 2025, like several state’s payroll schedule, is a vital doc for each employers and workers. Understanding its intricacies ensures well timed and correct payroll processing, stopping potential penalties and fostering a constructive worker expertise. This complete information delves into the important thing features of the 2025 New Jersey payroll calendar, providing priceless insights and sensible recommendation for navigating the complexities of payroll administration. Whereas a exact, official calendar is often launched nearer to the yr’s graduation by the state, we are able to anticipate its construction and key issues primarily based on earlier years and established practices.

Understanding the Fundamentals of New Jersey Payroll

Earlier than diving into the specifics of the 2025 calendar, it is important to know the foundational components governing New Jersey payroll:

-

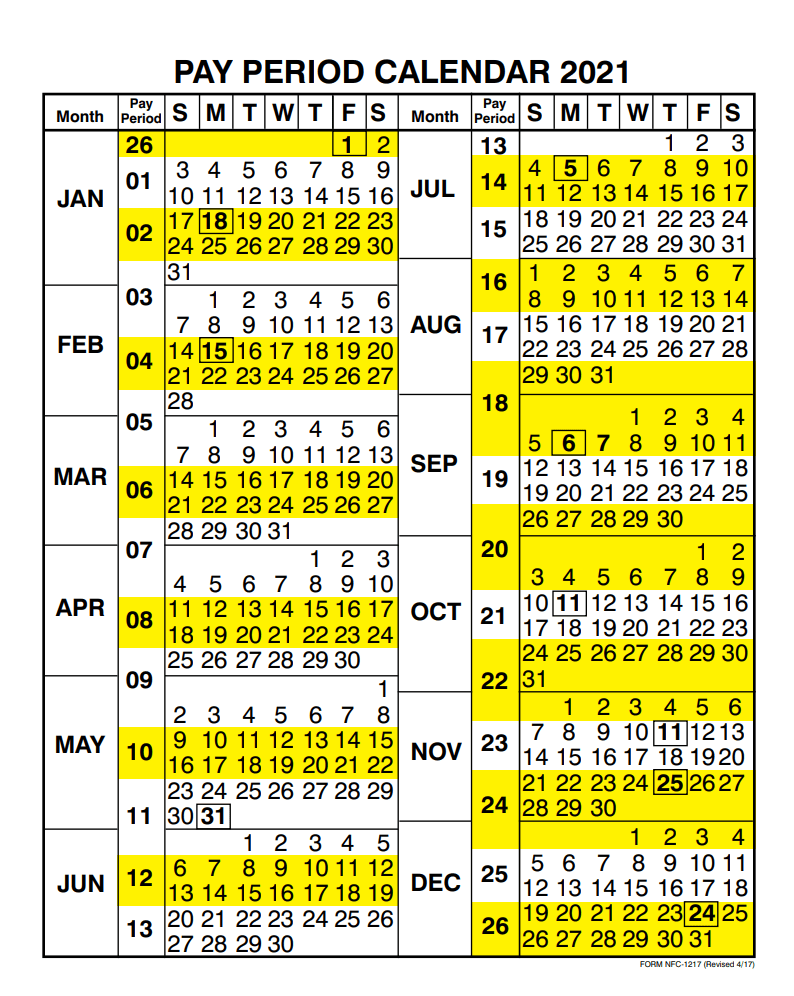

Pay Durations: New Jersey employers typically function on varied pay durations, together with weekly, bi-weekly, semi-monthly, and month-to-month. The selection of pay interval relies on components like firm dimension, business, and worker preferences. The 2025 calendar is not going to dictate the pay interval itself, however reasonably present the framework for figuring out payday throughout the chosen interval.

-

Payroll Taxes: New Jersey has its personal state revenue tax, in addition to unemployment insurance coverage (UI) and incapacity insurance coverage (DI) taxes. Employers are accountable for withholding state revenue taxes from worker wages and remitting these taxes, together with UI and DI contributions, to the New Jersey Division of Labor and Workforce Improvement. Understanding these tax obligations is paramount to correct payroll processing. Tax charges and laws are topic to vary, so staying up to date on the newest info from the NJ Division of Taxation is essential.

-

Federal Tax Withholding: Along with state taxes, employers should additionally withhold federal revenue tax, Social Safety tax, and Medicare tax from worker wages. These federal tax obligations are ruled by the Inside Income Service (IRS) and are impartial of the state payroll calendar.

-

Compliance: Adherence to all federal and state laws is necessary. Failure to conform can lead to vital penalties, together with fines and again taxes. Staying knowledgeable about adjustments in laws and sustaining correct payroll information are important for compliance.

Anticipating the 2025 New Jersey Payroll Calendar Construction

Whereas the exact dates for 2025 shall be formally launched, we are able to predict the overall construction primarily based on previous calendars. The calendar will possible not record particular paydays however reasonably spotlight key dates that affect payroll processing, similar to:

-

State Holidays: New Jersey observes a number of state holidays yearly. When a payday falls on a state vacation, employers typically modify the fee schedule to make sure workers obtain their wages on a well timed foundation, sometimes the previous enterprise day. The 2025 calendar will possible embody an inventory of those holidays, permitting employers to plan accordingly. These holidays embody, however usually are not restricted to, New 12 months’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas.

-

Tax Deadlines: The calendar could point out necessary tax submitting deadlines for state and federal taxes. Employers should meet these deadlines to keep away from penalties. These deadlines are sometimes quarterly or yearly.

-

12 months-Finish Processing: The calendar shall be essential for planning year-end payroll actions, together with W-2 preparation and distribution. Correct and well timed W-2s are important for workers to file their federal and state revenue taxes.

Sensible Ideas for Using the 2025 Payroll Calendar

As soon as the official 2025 New Jersey payroll calendar is launched, employers ought to take the next steps:

-

Obtain and Distribute: Get hold of a replica of the calendar and distribute it to related personnel throughout the payroll division.

-

Combine into Payroll Software program: If utilizing payroll software program, combine the calendar’s key dates into the system to make sure correct payroll processing.

-

Plan for Holidays: Account for state holidays and plan accordingly to make sure well timed fee of workers.

-

Tax Planning: Use the calendar to plan for tax funds and guarantee well timed remittance of taxes to the related authorities.

-

12 months-Finish Preparation: Make the most of the calendar’s year-end info to plan for W-2 preparation and distribution, guaranteeing compliance with deadlines.

-

Common Evaluate: Usually evaluation the calendar and any updates or adjustments to make sure accuracy and compliance.

Worker Issues

Staff also needs to familiarize themselves with the 2025 payroll calendar. Whereas they might not be straight concerned in payroll processing, figuring out the anticipated paydays helps with budgeting and monetary planning. Staff also needs to concentrate on their rights relating to well timed fee and will contact their employer or the New Jersey Division of Labor and Workforce Improvement in the event that they expertise any payroll points.

The Significance of Payroll Software program

Using payroll software program can considerably simplify payroll administration and scale back the chance of errors. Payroll software program typically integrates with the state’s tax programs, guaranteeing correct tax withholding and well timed remittance. Many software program options additionally automate varied payroll duties, saving time and assets.

Staying Up to date

The knowledge offered right here is for normal steerage. The official 2025 New Jersey payroll calendar ought to be consulted for correct and up-to-date info. Employers ought to frequently monitor updates from the New Jersey Division of Labor and Workforce Improvement and the New Jersey Division of Taxation to make sure compliance with all related laws.

In conclusion, the New Jersey payroll calendar for 2025 shall be an important software for each employers and workers. By understanding its construction, using its info successfully, and staying up to date on related laws, companies can guarantee correct, well timed, and compliant payroll processing, fostering a constructive and productive work atmosphere. Keep in mind to all the time check with the official calendar launched by the state for exact dates and data.

Closure

Thus, we hope this text has offered priceless insights into Navigating the New Jersey Payroll Calendar 2025: A Complete Information for Employers and Staff. We thanks for taking the time to learn this text. See you in our subsequent article!