Navigating The Yr With A Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information

By admin / September 11, 2024 / No Comments / 2025

Navigating the Yr with a Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information

Associated Articles: Navigating the Yr with a Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Navigating the Yr with a Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Navigating the Yr with a Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information

The yr 2025 is simply across the nook, and for a lot of, the rhythm of their monetary lives will as soon as once more be dictated by the acquainted bi-weekly paycheck. Understanding your pay schedule is essential for efficient budgeting, invoice fee, and long-term monetary planning. This complete information gives a framework for creating your personal customized 2025 bi-weekly pay calendar, alongside sensible ideas for managing your funds successfully all year long.

Understanding the Bi-Weekly Pay Interval:

A bi-weekly pay interval means you obtain your wage twice a month, sometimes each different Friday or on an identical recurring schedule. This differs from a semi-monthly pay interval, the place you are paid twice a month on particular calendar dates (e.g., the fifteenth and the final day of the month). The important thing distinction lies within the various variety of days between paychecks in a bi-weekly system. Typically you may obtain a paycheck encompassing 14 days, and different occasions, because of the various lengths of months, it may be 13 or 15 days.

Creating Your 2025 Bi-Weekly Pay Calendar:

Whereas a pre-made calendar particularly tailor-made to your actual pay dates and firm’s particular schedule will not be potential with out realizing your actual begin date, this information gives the instruments to assemble one your self. The method includes figuring out your first payday of 2025 after which persistently including 14 days to find out subsequent paydays.

Step-by-Step Information:

-

Decide Your First Payday: Determine the date of your first paycheck in 2025. Let’s assume, for the aim of this instance, your first payday is Friday, January third, 2025.

-

Add 14 Days Repeatedly: To calculate your subsequent paydays, persistently add 14 days to your earlier payday. As an illustration:

- January third + 14 days = January seventeenth

- January seventeenth + 14 days = January thirty first

- January thirty first + 14 days = February 14th

- And so forth…

-

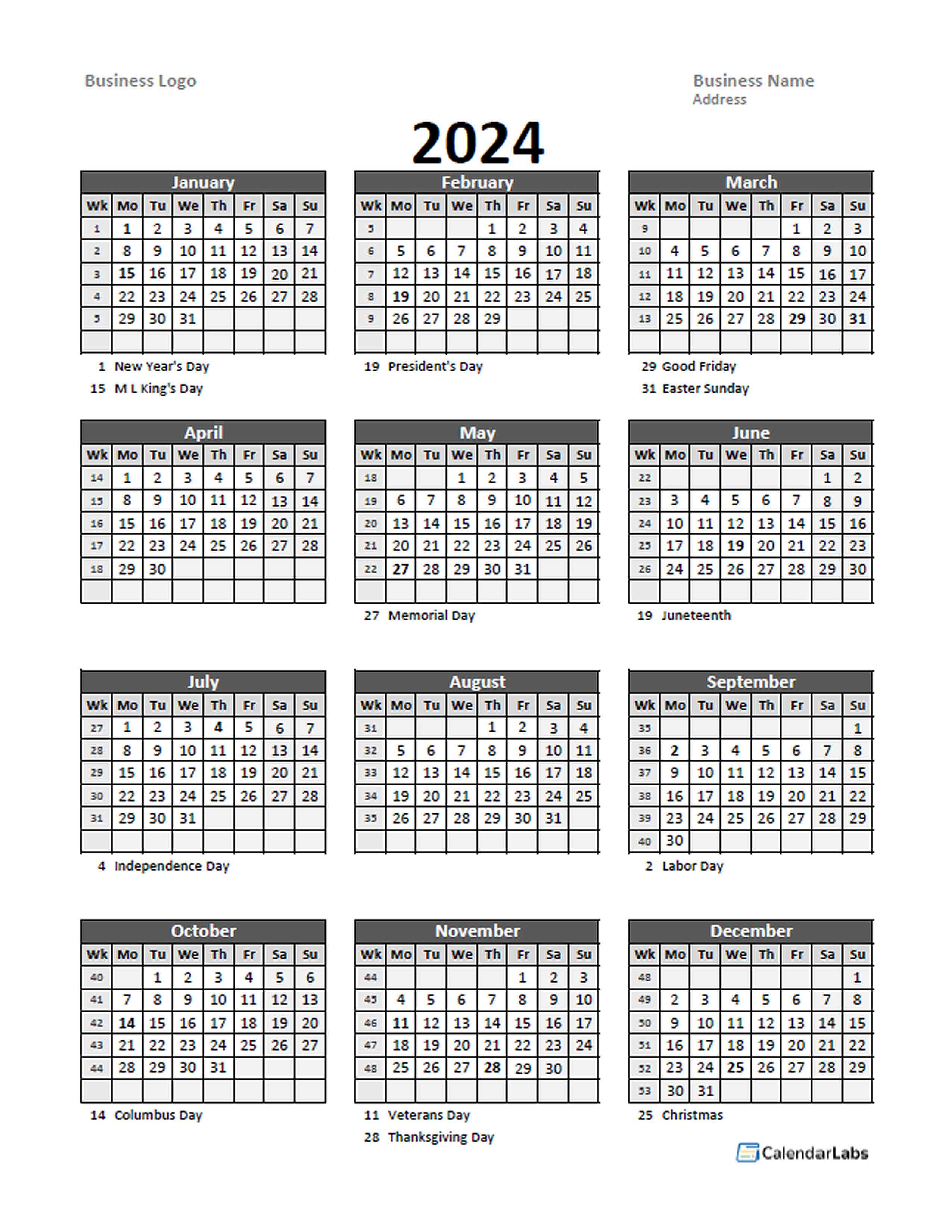

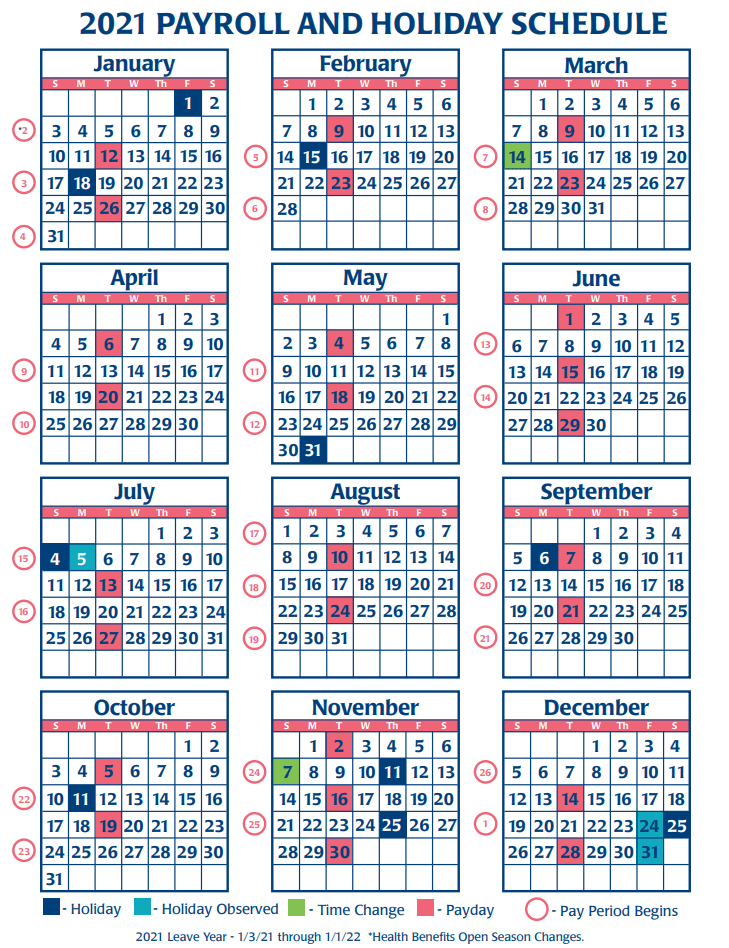

Make the most of a Calendar: Use a 2025 calendar (both a bodily one or a digital one) to mark these dates. This visible illustration will allow you to monitor your paydays all year long. You possibly can color-code these dates for simple identification.

-

Account for Variations: Do not forget that the variety of days between paychecks will differ barely because of the differing lengths of months. That is inherent to a bi-weekly schedule.

-

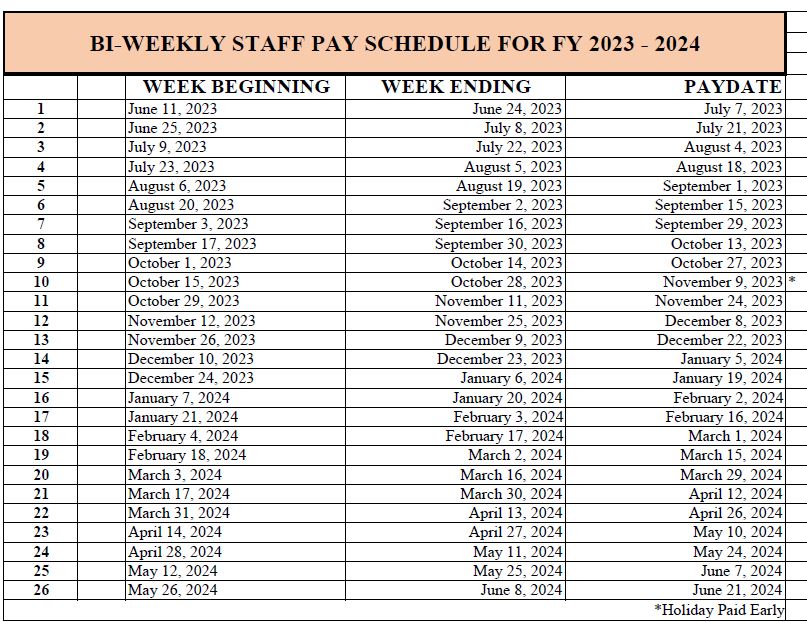

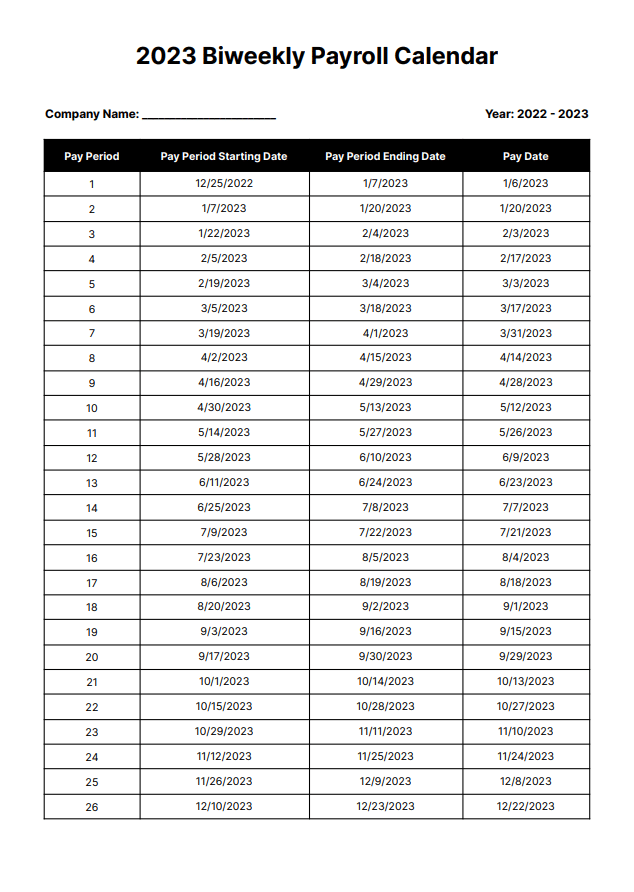

Create a Spreadsheet: For a extra organized strategy, create a spreadsheet with columns for "Pay Interval," "Begin Date," "Finish Date," and "Pay Date." This may present a transparent overview of your whole yr’s pay schedule.

Pattern 2025 Bi-Weekly Pay Calendar (Illustrative Instance – Based mostly on January third, 2025, Payday):

This can be a pattern and can differ relying in your first payday. You should calculate your personal based mostly in your particular circumstances.

| Pay Interval | Begin Date | Finish Date | Pay Date |

|---|---|---|---|

| 1 | January 3, 2025 | January 16, 2025 | January 17, 2025 |

| 2 | January 17, 2025 | January 30, 2025 | January 31, 2025 |

| 3 | January 31, 2025 | February 13, 2025 | February 14, 2025 |

| 4 | February 14, 2025 | February 27, 2025 | February 28, 2025 |

| 5 | February 28, 2025 | March 13, 2025 | March 14, 2025 |

| … | … | … | … |

(Proceed this desk for your entire yr, including 14 days to every subsequent pay date.)

Budgeting and Monetary Planning with a Bi-Weekly Pay Schedule:

As soon as you’ve got created your 2025 bi-weekly pay calendar, the subsequent step is to combine it into your monetary planning. Listed below are some key methods:

-

Budgeting: Allocate your revenue throughout important bills (lease/mortgage, utilities, groceries), debt funds, financial savings, and discretionary spending. Think about using budgeting apps or spreadsheets to trace your spending and make sure you keep inside your price range.

-

Invoice Cost: Align your invoice fee schedule along with your paydays. Arrange computerized funds every time potential to keep away from late charges and guarantee well timed funds.

-

Emergency Fund: Prioritize constructing an emergency fund to cowl sudden bills. Purpose to avoid wasting at the very least three to 6 months’ value of residing bills.

-

Debt Administration: Develop a plan to handle and pay down any excellent debt. Prioritize high-interest debt and discover debt consolidation choices if crucial.

-

Financial savings Objectives: Outline your financial savings targets (e.g., down fee on a home, trip, retirement) and allocate a portion of every paycheck in the direction of reaching them.

-

Investing: When you’ve got further funds after overlaying important bills and debt funds, think about investing in shares, bonds, or different funding automobiles.

Addressing Potential Challenges:

-

Various Paycheck Quantities: Do not forget that the variety of days in every pay interval will differ, leading to barely completely different paycheck quantities. Issue this into your budgeting to keep away from sudden shortfalls.

-

Sudden Bills: Life throws curveballs. Having an emergency fund and a versatile price range will allow you to navigate sudden bills with out derailing your monetary plans.

-

Monitoring Bills: Repeatedly monitor your spending habits and make changes to your price range as wanted. Monitoring apps and spreadsheets will be invaluable instruments.

Conclusion:

A well-organized 2025 bi-weekly pay calendar is an important instrument for efficient monetary administration. By meticulously planning your revenue and bills, you’ll be able to achieve management of your funds, obtain your monetary targets, and navigate the yr with confidence. Do not forget that this information gives a framework; you must personalize it based mostly in your particular pay schedule and monetary circumstances. Seek the advice of with a monetary advisor should you want customized steering. Proactive monetary planning is essential to a safe and affluent 2025.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the Yr with a Bi-Weekly Pay Schedule: A 2025 Two-Week Pay Interval Calendar & Planning Information. We respect your consideration to our article. See you in our subsequent article!